Fine Beautiful Info About How To Check For Identity Theft

Up to 20% cash back here are three tips on how to help protect against medical identity theft.

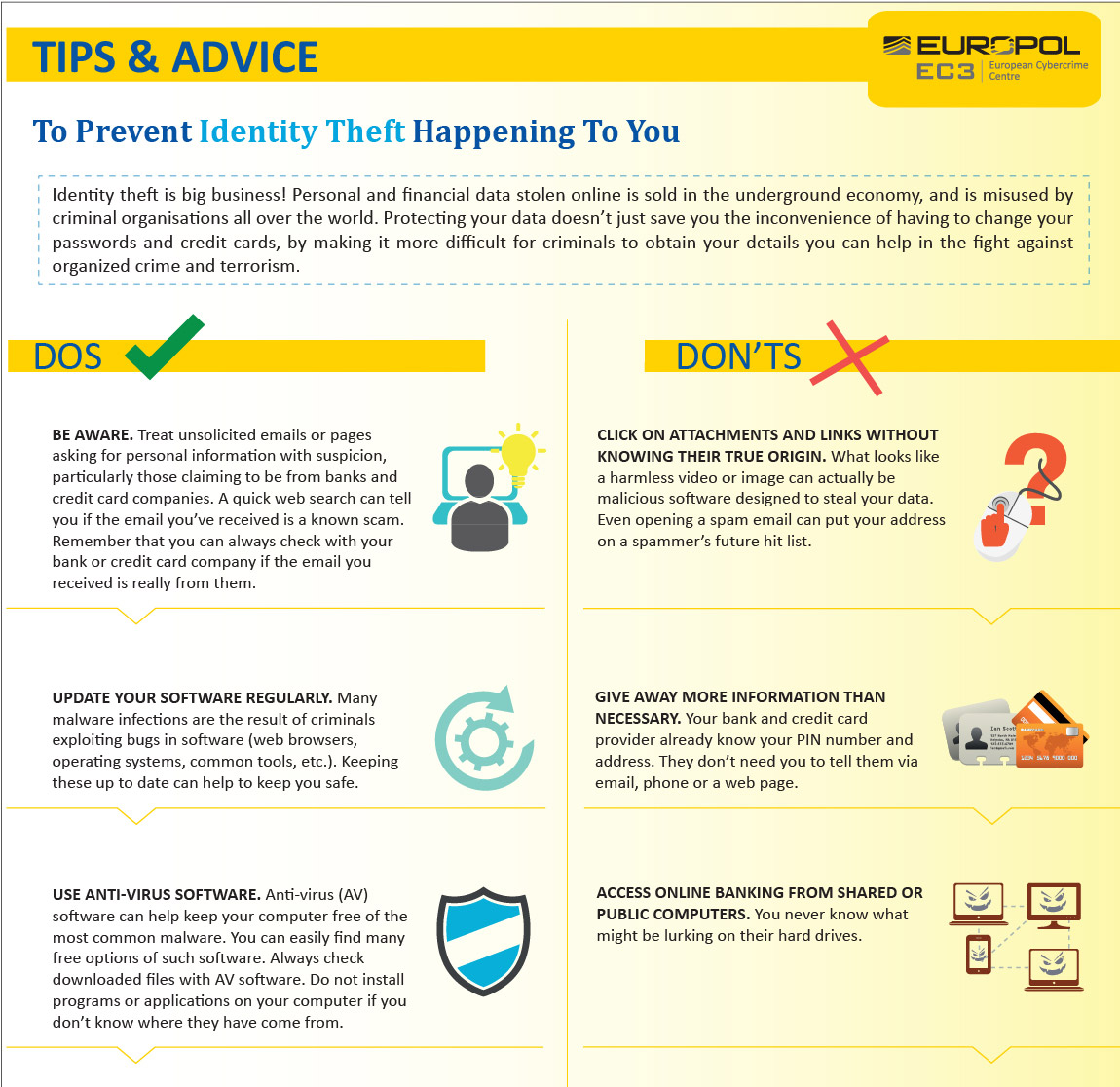

How to check for identity theft. Keep these tips in mind to protect yourself from identity theft: Let’s take a closer look at the signs of identity theft and learn how to check if your identity has been stolen: Ad identity theft happens to 1 out of 4.

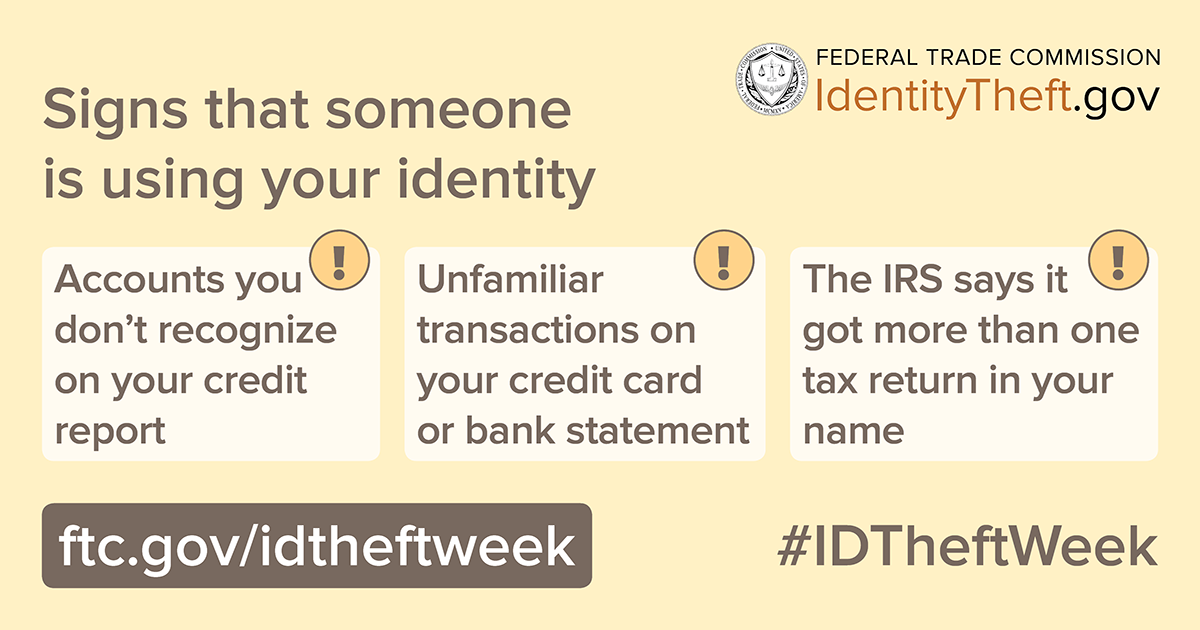

Ad get notified when new accounts & fraud alerts are detected on your experian® credit report. Up to 20% cash back check your credit report for unfamiliar accounts or charges to catch this warning sign of identity theft. Ad get protection from identity theft.

If you see a bank statement and see a transaction that you do. Don't carry your social security card in your wallet. Regularly check your account statements including credit cards, bank statements, telephone and internet bills for possible fraudulent activity.

Get a copy of your medical records. Check your bank account statement. Report and close the fraudulent accounts.

A letter identifying the fraudulent debts and information on your credit report; If you report by phone, you won’t get an id theft. Ad get notified when new accounts & fraud alerts are detected on your experian® credit report.

Check your credit report at least once a year to. F‑secure helps you to check if your private information appears in known data breaches. Contact the companies where fraud happened.