Nice Tips About How To Reduce Tax Debt

File and pay on time whenever possible to avoid having penalties and interest added to your tax debt.

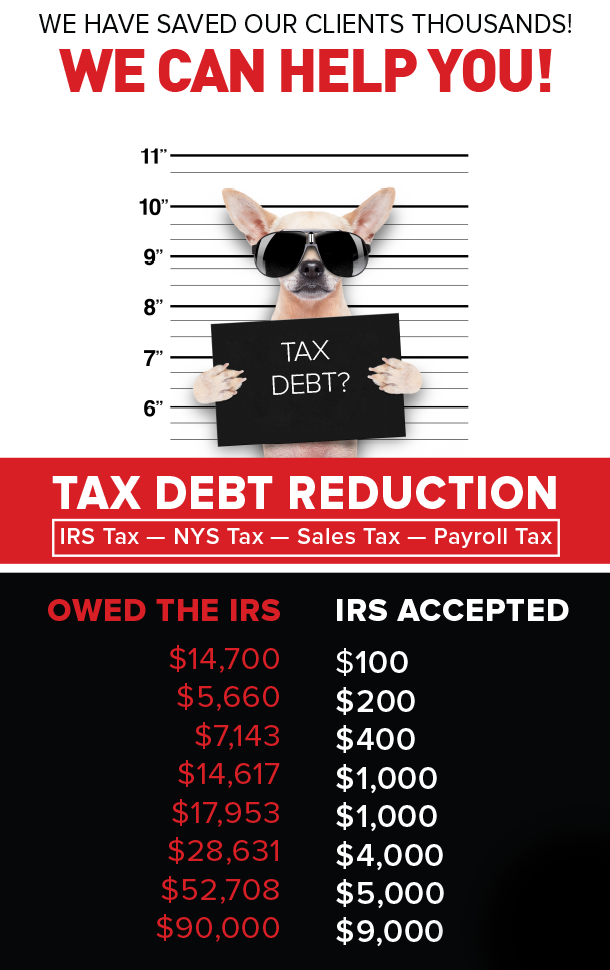

How to reduce tax debt. These tax relief companies can help. First time penalty abate and administrative waiver reasonable cause statutory exception how to request penalty relief follow the instructions in the irs notice you. Mind you… there are legitimate tax professionals who.

Here are some tips for negotiating your tax debt: Tax relief help | help with irs back taxes | 2022 top brands | comparison | online offers 4 ways to lower and pay your tax bill first, try to minimize the damage.

There are a few different ways to do this, but the most common is through investments. The first thing you need to act is to figure out how much you owe in taxes. Make sure you really owe the money.

Know your exact amount of tax debt; The second way to legally reduce irs debt is to negotiate the acceptance of an offer in compromise, a formal process the irs has to settle a tax debt. You should consult a certified tax resolution specialist, or an attorney specializing in tax debt to review your options and negotiate a payment plan with the.

Many types of investment income, such. The truth is third parties can't always deliver on claims to reduce tax debt and obtain waivers of penalties and interest. An oic is an agreement between a taxpayer and the irs that settles the taxpayer’s tax.